“What’s with that?” a student asked me. Our classroom this semester was on the third floor of Barker Hall at the University of Kentucky. The flights are tall and there is no elevator. “How is that allowed?”

The young woman was asking about accessibility. It’s 2016. Don’t campus buildings have to be accessible?

Before moving to Lexington, I advocated for certain accessibility issues at the University of Mississippi. In the process, I learned a lot about what people say when you push on such issues. There were many disappointing responses at times, the most upsetting of which was being ignored for nearly a year. That’s another story.

Before moving to Lexington, I advocated for certain accessibility issues at the University of Mississippi. In the process, I learned a lot about what people say when you push on such issues. There were many disappointing responses at times, the most upsetting of which was being ignored for nearly a year. That’s another story.

The experience in Mississippi revealed to me some interesting challenges to consider even when an organization means to do its best to make a social space maximally accessible.

If you want to advocate for change, critical thinking textbooks will tell you, you have to understand your opposition and address it head on. Finding the weakest arguments that oppose your mission and laughing at them won’t convince people who disagree with you. Identifying the smartest things people say in their defense and responding to those might.

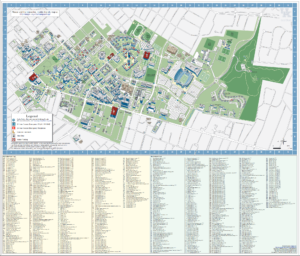

How many buildings are on a university campus? It will vary significantly, but let’s imagine that there are 200 at a major research university. If the campus has been around a long time, many of the buildings will have been built long before the Americans with Disabilities Act. Some will be historic buildings. Others in need of repair. Some will be priorities and others won’t.

How many buildings are on a university campus? It will vary significantly, but let’s imagine that there are 200 at a major research university. If the campus has been around a long time, many of the buildings will have been built long before the Americans with Disabilities Act. Some will be historic buildings. Others in need of repair. Some will be priorities and others won’t.

Classroom space tends to be at a premium in most institutions. When all of the most commonly used spaces have been taken up, you look for further spots not yet in use. My courses were added far later than is usual this past summer, so they were located in classroom space still available. It so happens that that means Barker Hall.

Barker Hall is historic, built in 1901. The first photo of it is how it looks now, although it is actually surrounded by construction of the new student center at present. The next photo showcases what we mean when we call it historic.

Barker Hall is historic, built in 1901. The first photo of it is how it looks now, although it is actually surrounded by construction of the new student center at present. The next photo showcases what we mean when we call it historic.

So why isn’t it accessible?

- Making spaces accessible as you build them is cheaper than retroactively. So, it’s more expensive than making other, perhaps more spacious new buildings accessible.

Making historic buildings accessible generally adds cost, because it is desirable to preserve the beauty of historic buildings, while retrofitting. It’s harder, so it costs more.

Making historic buildings accessible generally adds cost, because it is desirable to preserve the beauty of historic buildings, while retrofitting. It’s harder, so it costs more.- It probably is not the only remaining space that needs retrofitting.

- Money is always limited and judgments are made all-things-considered about where to spend it.

- Without many people calling for Barker to change, it won’t any time soon. Though, there may be plans in the works to update it at some point.

But wait, “Isn’t it the law?!”

- No, it’s not technically the law that every space has to be accessible to every person. The law says that institutions like mine have an obligation to make reasonable accommodations for people who need them. That means that if any of us had a broken ankle or if a student who uses a mobility device were to have added the course, the university would have had to find some solution to move the class meetings.

This last point is delicate, though. How would it make you feel if 30 other people had a change to their meeting location for a semester because of you? It’s something that couldn’t help but make someone feel singled out. Maybe the first classroom was conveniently located for certain people. Barker Hall is a hop away from Patterson Office Tower, where my office is. So, in the end, this answer is not terribly satisfying.

My point here is not that I think it’s fine to have inaccessible buildings. Hell, the window unit air conditioners made it hard to hear each other in August, a problem for people with hearing impairments, not to mention anyone trying to engage in a classroom discussion.

No, this professional baseball team executive has nothing to do with the story here, except that he’s struggling to hear someone, as I often did this semester.

So, at some point I’ll gently start to ask questions about what the structure is here for decisions and initiatives regarding accessibility. It was refreshing, I must say, to hear disdain in the student’s voice. I heard passion and initiative in it. You can’t change much for the better without high expectations. At the same time, the challenges are real even when good people are trying to do many things right with limited resources.

Next semester, I’ll be teaching on the second floor of a building with several elevators. And central air.

Follow me on Twitter @EricTWeber and on Facebook @EricThomasWeberAuthor.

The right to create money and profit from it is known as seignorage. Banks currently enjoy this right and exercise it through their lending, which creates most of the money in circulation. Governments have effectively let banks privatize control of the money supply. In so doing, governments have forfeited the opportunity to provide debt-free lending to support productive enterprises and public needs as opposed to fueling boom-and-bust speculation and relentless economic growth that destroys the environment.

The right to create money and profit from it is known as seignorage. Banks currently enjoy this right and exercise it through their lending, which creates most of the money in circulation. Governments have effectively let banks privatize control of the money supply. In so doing, governments have forfeited the opportunity to provide debt-free lending to support productive enterprises and public needs as opposed to fueling boom-and-bust speculation and relentless economic growth that destroys the environment.